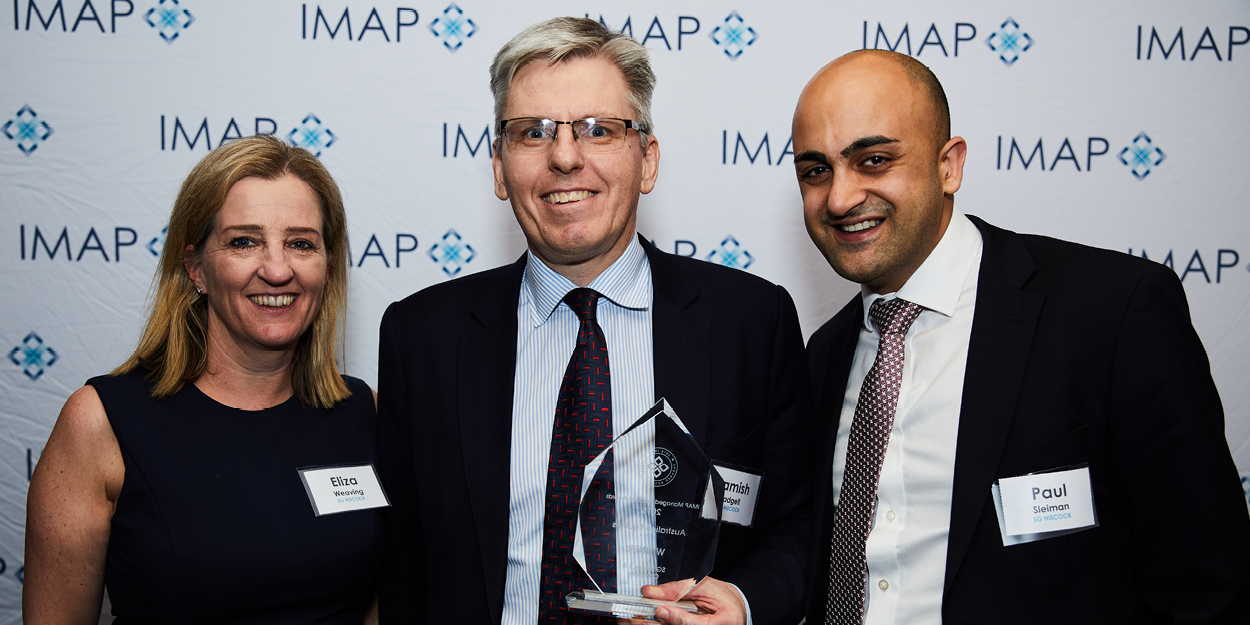

Boutique investment manager, SG Hiscock & Company has taken out the Australian Equities category at the IMAP Managed Account Awards.

By investment standards, Melbourne-based SG Hiscock & Company is relatively young, having established in 2001, but it is an investment manager with a long track record of consistently outperforming the market. The boutique business is entirely owned by its staff and specialises in Australian equities and property securities, including Australian and global REITs.

The IMAP Managed Account Awards judges presented SG Hiscock & Company with the Australian Equities award for its SGH20 fund.

The SGH20 fund is an actively managed, high-conviction, broad cap Australian equity fund that invests in a concentrated portfolio of between 15 to 25 ASX-listed companies. The fund is not constrained by index or sector weights and aims to achieve returns in excess of 5 per cent above both the S&P/ASX300 Accumulation Index and cash over rolling five-year periods (before fees and taxes).

The SGH20 fund, along with a number of other high-conviction funds, is available on various managed account platforms, including OneVue and Hub24.

“In order for us to generate different investment performance from the crowd, we’re big believers that you need to do something different and that’s something we do through out concentrated benchmark unaware approach,” says SGH20 portfolio manager, Hamish Tadgell.

SG Hiscock employs a high-conviction, active management approach to investing, which is founded on its ValueActiveTM investment process - used by the investment team for more than a decade. It combines bottom-up analysis with a forensic approach to company research, market fundamentals and insight.

“We believe our high-conviction, active approach to investing is well placed in the managed accounts environment,” says Hamish. “We’re strong believers that this approach, when implemented in a disciplined manner, is a way to create value and outperformance over the longer term.”

In order to identify the best opportunities to help clients achieve their financial goals, SG Hiscock undertakes a broad fundamental research program that incorporates an extensive schedule of company visits. With an experienced team of investment professionals, the manager also engages a select team of external research providers to complement its insights in the macroeconomic landscape (both locally and abroad) and general investment trends.

Client communication

Central to SG Hiscock’s approach to investing is the way in which it communicates with clients.

“Investing is not just a transaction, it’s a journey,” Hamish says. “Over time, we look to build a conversation with our clients, so they understand what we’re doing and how we come to make decisions and invest their money.

“Ultimately, we see that as a partnership, where we look to become the trusted manager in helping investors achieve their financial goals.”

And part of that partnership includes the active engagement of SG Hiscock with its clients that includes seeking feedback through regular updates and forums.

“This client engagement is a part of how we measure our success, with the other part being the performance of our funds over the medium and long-term. Since its inception, the SGH20 fund has outperformed its benchmark by an average of 4.5 per cent per annum over the last 14 years, which is a strong endorsement of our approach.”

IMAP Awards

Hamish also views winning the IMAP Managed Account award for the Australian Equities category as another measure of success for SG Hiscock, providing it with recognition and third-party confirmation of the rigorous internal investment process used across its funds.

“Naturally, it’s a great honour to be named a finalist, let alone win an industry award, so we are very proud to be recognised as the inaugural winner of this IMAP award,” Hamish says. “It’s particularly satisfying when you consider the quality of the peer group we were up against.

“I’ve never thought of awards as being ‘the best in what you do’. Instead, I see awards as confirmation that what you are doing is valued by the wider industry and clients. So, it’s very rewarding for the team at SG Hiscock & Company to be recognised in this way.”

Finalists

IMAP congratulates all the finalists in the Australian Equities category.

- Bennelong Australian Equity Partners

- DFS Portfolio Solutions

- DNR Capital

- Macquarie Investment Management

- SG Hiscock & Company

- Shaw and Partners