Inter-generational wealth transfer is set to transform the financial landscape in Australia. Damon Riscalla (Betashares) discusses what matters most to each generation, and provides insights on how advisers can strengthen and sustain these valuable connections.

With trillions of dollars set to be passed onto the next generations in the coming decades, this significant wealth transfer will reshape the financial landscape. In Australia alone, it’s estimated that around $3.5 to $5.4 trillion in assets will be passed down from Baby Boomers to younger generations by 2050.

Recent findings from the Productivity Commission (Wealth transfers and their economic effects, November 2021) show that wealth accumulation is growing in retirement. This is due to a number of factors, including: preferential tax treatment within superannuation, and assets held outside of the super environment.

The Productivity Commission found that inter-generational inheritances and gifts more than doubled since 2002 and could rise four-fold in real terms between now and 2050, as household wealth grows and the population ages. The study found that over the past two decades, the total value of wealth transferred in Australia was approximately $1.5 trillion, and about 90 per cent of that was inheritances.

This significant inter-generational wealth transfer will not only fundamentally alter the landscape for financial advice in Australia, but provide advisers with significant opportunities to advise new generations of clients. However, Damon Riscalla — National Head of Practice Development at Betashares — believes that as generational needs evolve, advisers must adapt their approach to foster trust, align strategies with emerging financial goals, and enhance client engagement

By Jayson Forrest

Damon Riscalla

Betashares

Addressing the topic of ‘Intra and inter-generational advice’ at the IMAP Advice in Action 2025 conference, Damon says not only is wealth transfer happening as inheritances, but also as gifting, with an increased willingness by people to give to charities or other people outside of their immediate family.

An interesting observation from Damon is around longevity. With women generally expected to live longer than men, this means there will be a period — about 5-10 years — where wealth is transferred to the surviving spouse, who will be responsible for managing a significant amount of wealth.

“Industry research shows that 94 per cent of women want to learn more about financial planning,” says Damon. “By engaging more closely with female clients, advisers will be well-positioned to assist them with inter-generational wealth transfer, which opens up opportunities to connect more closely with their families.”

Damon adds as part of the trend towards gifting, he expects to see more inter vivos transfers — the transfer of property or assets from one living person to another during the transferor’s lifetime.

“With the Government’s proposed tax on unrealised capital gains, we’re already seeing tinkering with super, which is likely to cause some investors to lose faith in the system. This may see people start to think about passing on wealth earlier than expected,” says Damon.

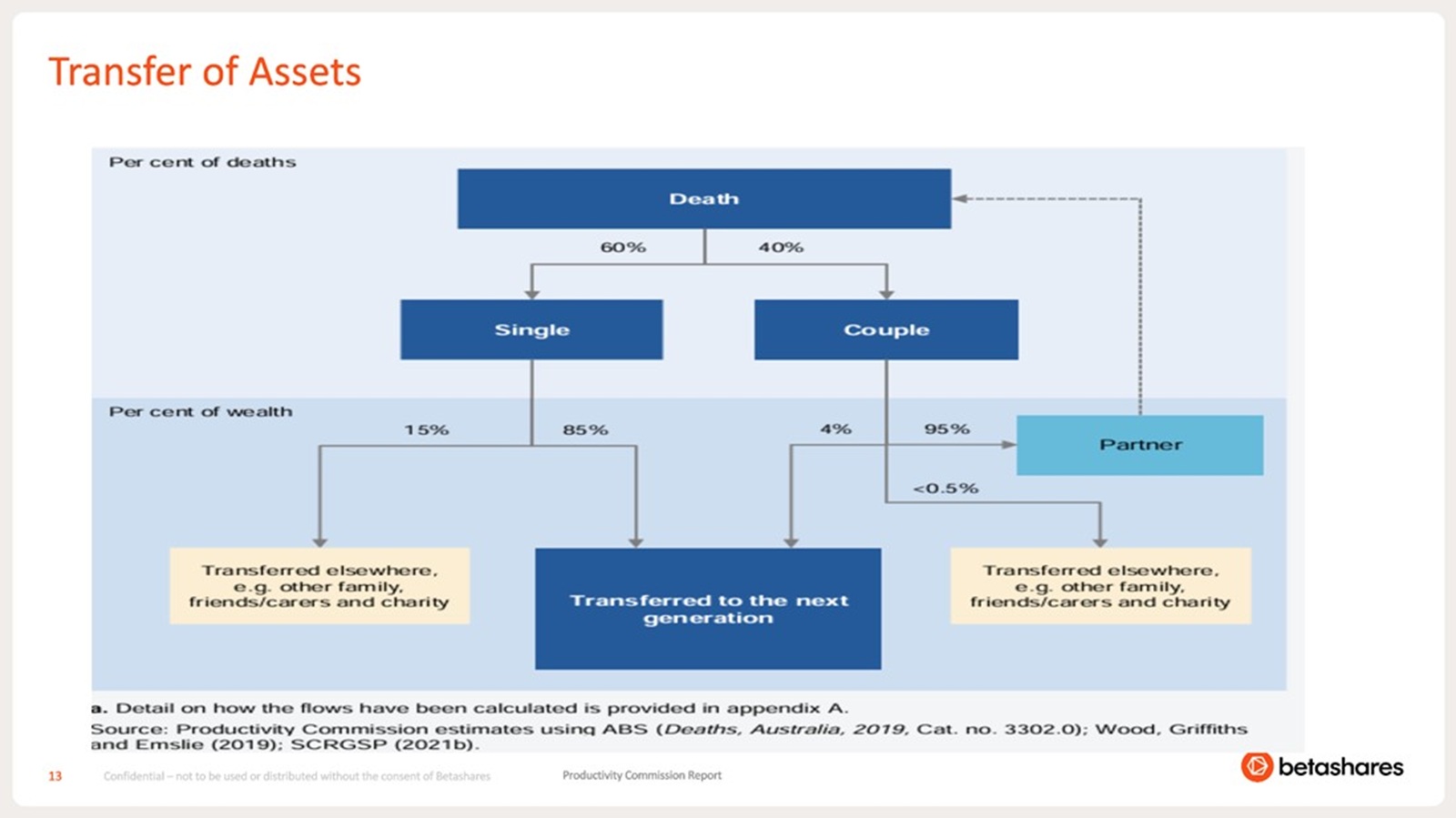

Chart 1: Transfer of assets

With the Government’s proposed tax on unrealised capital gains, we’re already seeing tinkering with super, which is likely to cause some investors to lose faith in the system. This may see people start to think about passing on wealth earlier than expected

Understanding the generations

The key to working effectively with different age cohorts of clients as part of generational wealth transfer, is to understand the characteristics of the various generations.

For most advisers, this will primarily mean working with Baby Boomers (1946-64), Gen X (1965-80), and Millennials (1981-96).

Baby Boomers: Representing 5.5 million Australians, this generation is characterised as being:

- Optimistic, confident, and nostalgic;

- Competitive and workaholics;

- Young at heart and being a unified generation;

- Mass affluent, with lower technology adoption; and

- The largest wealth holding generation.

“Baby Boomers like to be sold, so advisers shouldn’t be shy of selling them the sizzle,” says Damon. “They like solutions that are customised for them and are prepared to pay for it. They do like ‘trophies’, like luxury cars, because it demonstrates they’ve done well and have worked hard. So, advisers need to allow for that in their planning.

“As an adviser, you should be detailing every single step you take with Baby Boomers, because that’s what they like and they find it reassuring. And they also like face-to-face engagement.”

Gen X: Accounting for 4.9 million Australians, this cohort are generally more sceptical and cynical than their parents. Common characteristics of this generation include:

- They are the first tech savvy generation;

- They are guarded and protective;

- They use technology for practical reasons;

- They are self-reliant and independent; and

- They are prepared to sacrifice the long-term for the short-term.

“When it comes to financial advice, Gen X isn’t interested in the sizzle, they just want to know what it’s going to cost them,” says Damon. “They want research and, if possible, they want you to provide them with an avenue for self-service.

“Gen X has grown up in an era where they’ve seen multiple corporate and market failures, so they love back-up plans. This means advisers need to prepare multiple strategy options for these clients.”

Millennials: Standing at 5.4 million Australians, Millennials are educated, tech savvy, and enjoy a connected world and marketplace. Some of their characteristics include:

- They have a high sense of entitlement;

- They are desensitised to media and marketing;

- They expect lower levels of formalities compared to previous generations;

- They are in a hurry and have low levels of patience; and

- They have lofty goals and high levels of ambition.

“This generation is typically impatient, so if there is an issue, they want it dealt with quickly. This means ensuring you give them first contact resolution.

They also love links and access to external sources of information, so consider embedding these in your website.”

There is a definite swing to investments like crypto currency and thematic investing for Millennials. So, if advisers haven’t been dealing with these types of investments, then that’s something they should consider doing

What stops generational wealth transfer?

According to Damon, there are numerous reasons why the next generation may choose not to engage the services of an adviser with their inherited wealth. These include:

- Debt reduction — using their inheritance to pay off debt, like mortgage and credit card debt.

- Sibling privacy issues — when an inheritance flows through to siblings, they generally don’t want to work with the same adviser their siblings are using. They don’t understand the privacy conditions that exist between an adviser and their client, which needs to be explained by the adviser.

- Lack of generational match — clients feel more comfortable working with advisers of their own generation, as they better understand their needs and objectives. This means advice practices need to include Gen X and Millennial advisers in the advice team.

- Mismatched strategies — investment strategies that worked and appealed to Baby Boomers may not have the same appeal for younger generations.

- Not perceived as the ‘family adviser’ — there’s the risk that planners are seen as the adviser of ‘mum and dad’, and not somebody the younger generation wants to engage with once they receive their inheritance.

“By better understanding these potential barriers to advice, advisers can engage more closely with the next generation about their concerns, and allay any unease they may have in continuing to work with them.”

Be aware of each generation, as their investment preferences do differ. Some generations are happy to pay for active management, while others hate it. These are the types of issues advisers need to carefully consider when constructing portfolios for different generations of clients

The legacy requirements of over 50s

With Australians living longer, it’s not surprising that most generational wealth transfer is happening with people aged over 50. Damon believes it’s important for advisers to not only understand the investing preferences of the over 50s, but also the financial legacy they would like to leave.

“For the over 50s, whether male or female, there is a desire to give back. It’s beneficial that advisers have a ‘corporate halo’ (a cognitive bias where a positive impression of a business in one area — like charitable work — influences a client’s perceptions of other areas, such as corporate social responsibility), which is something that particularly resonates with female clients,” says Damon.

“So, if advisers are involved with a charity or doing some charitable work, that will be hugely beneficial for them. And you should also consider having discussions about ESG and socially responsible investing, which are investment areas that are gaining interest with older investors.”

Another area of advice advisers should be pro-active in is engaging in estate planning conversations with their clients — the earlier, the better. Damon believes that by encouraging clients to have this discussion openly with their family, advisers have the opportunity to connect more closely with the children and grandchildren of clients.

If you’re an advice business that has a lot of high-net-worth clients who are ageing, you can lose a lot of business very quickly. That’s why you need to have multi-generational conversations and engagement with your clients and their families now

A generational approach to investing

Whilst Baby Boomers, Gen X, and Millennials are comfortable with investing in stocks, they also share a common appetite to pay down debt. However, Damon acknowledges there are differences to how these generations approach investing that advisers need to be aware of.

“There is a definite swing to investments like crypto currency and thematic investing for Millennials,” says Damon. “So, if advisers haven’t been dealing with these types of investments, then that’s something they should consider doing.”

Data from Charles Schwab (Modern Wealth Survey 2024) supports this premise, showing that Millennials are particularly interested in thematic investing — 41 per cent — compared to Gen X (20 per cent), and Baby Boomers (9 per cent). Millennials also have a stronger appetite for socially responsible investing (45 per cent), compared to Gen X (27 per cent), and Baby Boomers (17 per cent). However, it’s the Baby Boomers (60 per cent) who prefer a ‘buy and hold’ strategy, compared to Gen X (48 per cent), and Millennials (59 per cent).

According to Damon, advisers need to consider potential investment strategies and opportunities for these generations that best match their different life stage priorities. For example, a core-satellite approach to portfolio construction won’t resonate with all three generations.

“Be aware of each generation, as their investment preferences do differ. Some generations are happy to pay for active management, while others hate it,” says Damon. “These are the types of issues advisers need to carefully consider when constructing portfolios for different generations of clients.”

Connecting with the next generations

Ask Damon for his best tips for connecting with the next generations of clients, and he offers the following five suggestions:

1. Life coaching for future generations;

2. Financial coaching for children and grandchildren;

3. Provide specialist aged care planning;

4. Strategic advice around the use of family equity; and

5. Family assistance measures, like credit checks for family members.

“Anything you can do to get the whole family involved with the financial planning process, will help position yourself as a trusted adviser to the whole family, including the client’s children and grandchildren,” says Damon.

“If you’re an advice business that has a lot of high-net-worth clients who are ageing, you can lose a lot of business very quickly. That’s why you need to have multi-generational conversations and engagement with your clients and their families now.”

About

Damon Riscalla is National Head of Practice Development at Betashares.

He spoke on the topic of ‘Intra and inter-generational advice’ at the IMAP Advice in Action 2025 conference.